Who Controls the Banking Function

In my previous article I discussed why I reject the term “Traditional Finance” with regard to the common methods of building capital for large expenses, planning for passive income at retirement, and financing all of your life.

I prefer to call it conventional. It is the method endorsed and approved by the financial industrial complex and the government. It is “in accordance with what is generally done” but it is not “long established, passed from one generation to another.” It is not traditional.

Conventional finance does not solve the problem of financing your life. It is not designed to. It exists for an entirely different purpose and to benefit a different group.

Conventional finance is at best a misunderstanding of the problem. At worst it is hiding or deliberately misrepresenting the problem. Conventional finance portrays the problem as not earning enough money, therefore we must put our hope in the stock market to produce enough money to produce retirement income. But the stock market created to allocate capital, not generate passive income. In order to overcome this fact, we put our hope in experts and their professional speculation in the market to provide for your future.

You must also hope on the continued generosity of the government to allow you to keep more of your money now, but paying more later, such as with qualified or tax deferred plans. You also have the option to reduce your taxes in retirement with non-qualified plans – but generous Uncle Sam limits how much you can put in these accounts. Well, hope is not a plan, our trust of self-appointed experts has waned, and the scariest words in the English language are “I’m from the government and I’m here to help.”

In actuality, the problem is the control of capital and control of the banking function.

Government and conventional finance want more control of our capital. They want our assets under their management. They want you to be a captive client to their companies, buying their products, and paying them finance charges. Meanwhile, our ability to save and plan and prosper is dependent on us having control of our capital. Nelson Nash demonstrated in BYOB that the problem is called “financial headwind.” A headwind created by the financial industrial complex through usurious interest rates, fees, and other finance charges. A headwind strengthened by the government through onerous taxation.

In the conventional finance paradigm, the government portrays YOU as the problem – you do not save enough for retirement, so they need to encourage it through taxes and enforce it through Social Security. The solution then is control. More taxation under the guise of forced retirement savings (social security). Controlling your behavior through tax incentives. Thus, they create various tax advantaged retirement plans. Everyone has an available exception through 403b’s, 401k’s, SIMPLE plans, SEP Plans, Keogh, and Roth IRAs. Wouldn’t it be easier to reduce taxes than to grow the monstrous bureaucracy required to monitor and manage these plans?

The financial industrial complex sees you as an income stream. They see your capital as money to be risked on investments and reallocated for themselves. They want your assets in the market so they can speculate with it, where you take the risk, and they get the reward.

“Do you really want to invest in a system where you put up 100% of the capital and as the mutual fund shareholder you take 100% of the risk, and you get 30% of the return?”

– John Bogle, founder of Vanguard Investments

The solution isn’t just to avoid the conventional headwind, take your money out of the system and put it in your mattress. The solution is to take control turn it into a self-controlled tailwind, put it in your own bank. Take control of the banking function in your life.

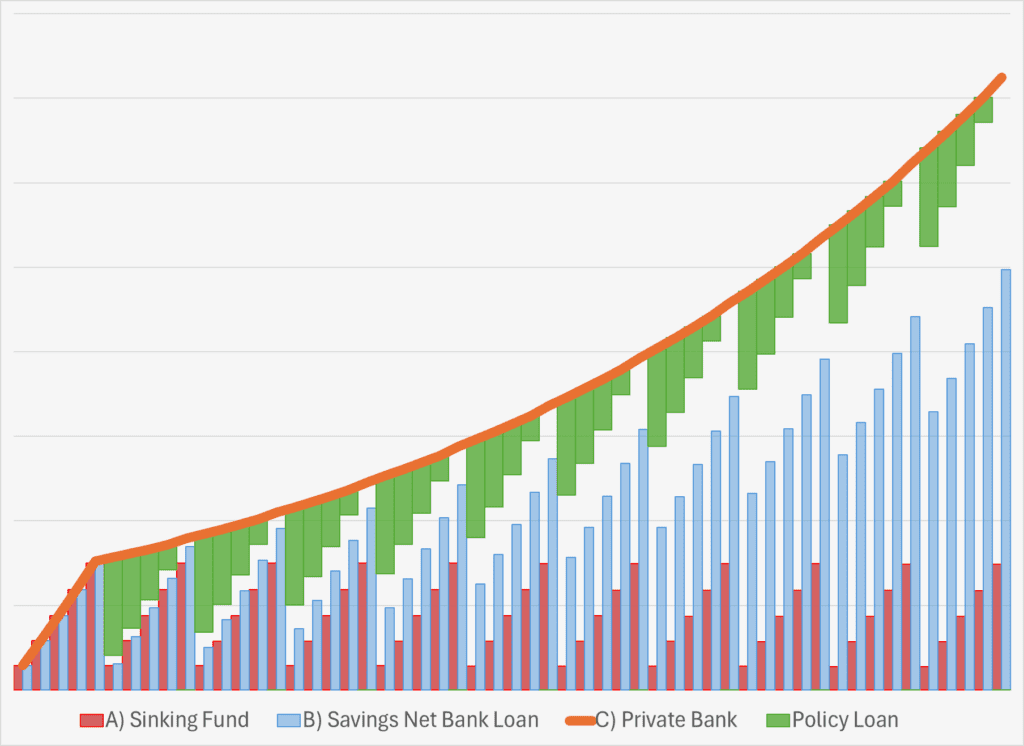

You can create that tailwind by Becoming Your Own Banker. Instead of paying finance charges to someone else’s bank, they are paid to your bank. If you have determined to buy a $30,000 car you have 3 methods of paying for it. For simplification, let’s assume you have been a diligent saver, having defeated Parkinson’s Law, (BYOB, page 28) and have a savings account with exactly $30,000 in it. No additional inflows or expenses are considered.

Consider these options:

A) Sinking Fund. This is the method advocated by Ramsey and Orman. Spend $30,000 in cash now. You have no monthly payment. At the end of 5 years 1) you spent $30,000, 2) you have a car and 3) $0 in savings. But you also gave up $4800 in interest your $30,000 could have earned in a savings account in those first 5 years (at 3% interest rate) plus all future interest. Your $30k was spent – it can’t earn any interest ever again.

B) Bank loan. Spend $0 now, pay $580/month for the next 5 years on a 6% APR note for a total of $30,000 + interest of $4,800. At the end of 5 years 1) you have spent $34,800, 2) you have paid off your car, 3) your original $30,000 in savings and an additional $4,800 in savings (at 3% interest rate). Note, you paid 16% interest by volume ($4,800/$30,000 = 16%). But Uncle Sam taxed that $4,800 earned and you only got to keep $3,840. Net $33,840.

55 Year working life, buying a car every 5 years

C) Finance from your personal bank. Spend $0 now, pay $580/month for 5 years repaying the policy loan. The loan is paid off 3 months faster, an extra $1740 ($580×3) is paid to your bank. At the end of 5 years 1) you have spent $34,800 – what you would have paid someone else’s bank, 2) you have a car, 3) and the capital you have available is now $36,540: your $30,000 + $4,800 interest + 1740 additional capital. That $4,800 is not taxed. Oh, and you also have death benefit protection.

In each instance you spent $34,800 in 5 years.

After 5 years you need to buy a car again. However, because of inflation, that $30,000 car now costs $34,800. (3% inflation for 5 years). With option A, you’ve gone backwards – you have $0 in your savings (remember, we isolated out additional cash flows). With option B you’ve basically stayed even. But by Becoming Your Own Banker, you’ve come out ahead by doing the things you were going to do anyway.

Financing your cars and homes isn’t the only way to take control. You can apply this to all the things you’re already doing or going to do.

Instead of taking the property tax payment out of your savings account, use a loan from your bank. Instead of saving for the next property tax bill repay your policy loan.

Stocks? Bitcoin? Real estate? Finance it through your bank, not theirs. You’ll be better prepared to weather any volatility in these markets.

Paying for kids’ college? Finance it with your bank. As they repay their “student loan” they are restoring the death benefit they will receive at your graduation (euphemism for death – as Nelson would say, “we all have to graduate some day”).

When your child needs to buy a car – finance it for them. You can finance the down payment on their house and in time finance their home purchase. In doing that, they will simultaneously contribute to your retirement income and their own inheritance.

This can even be used to refinance other debts enabling you to get out of debt faster and with more control – no debt collectors.

If you’re ready to talk to someone about taking control of the banking function in your life, book a free call with an advisor today.

Semper Reformanda

All content on this site is intended for informational purposes only and is not meant to replace professional consultation. The opinions expressed are exclusively those of Reformed Finance LLC, unless otherwise noted. While the information presented is believed to come from reliable sources, Reformed Finance LLC makes no guarantees regarding the accuracy or completeness of information from third parties. It is essential to discuss any information or ideas with your Adviser, Financial Planner, Tax Consultant, Attorney, Investment Adviser, or other relevant professionals before taking any action.

Awesome post! Really enjoyed reading it.